100% Electric Bikes & Scooters

-

Save £300. Offer ends 30/04/24*

The all new Piaggio 1 is the bike the electric moped market has been waiting for, fantastic looks, plenty of tech, removable batteries this Active version provides improved performance and battery range over the standard version.

Price includes £500 OZEV grant

-

Save £300. Offer ends 30/04/2024*

The all new Piaggio 1 Feng Chang Wang combines start of the art Motorcycle engineering with cutting edge fashion to deliver this years hottest electric scooter. This Active version provides ideal city performance with a top speed of 37mph and upto 41 battery range in spot mode.

Price includes £500 OZEV grant & discount.

-

Save £300. Offer ends 30/04/2024

The all new Piaggio 1 is the bike the electric moped market has been waiting for, fantastic looks, plenty of tech, removeable batteries and a price making it the cheapest 50cc (equivalent) in Piaggios line up. What are you waiting for?

Price includes £150 OZEV grant & discount.

-

Save £1000 – while stocks last!*

The best selling electric maxi scooter that does everything a 125cc petrol can do, but better, introducing the Super Soco CPx. This dual battery version offers double the range of the standard model.

Price includes £500 OZEV Grant but excludes £55 registration fee

Sale! -

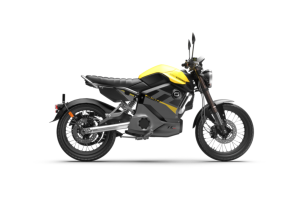

The first 60 mph, 125cc equivalent Super Soco – extra urban commuting just got electric!

DEMO AVAILABLE

Price includes £500 OZEV Grant.

-

The first 60mph, 125cc equivalent Super Soco – extra urban commuting just got electric!

DEMO AVAILABLE

Price includes £500 OZEV Grant

-

Save £300. Offer ends 30/04/24*

The gutsiest small body in the range pushes that Vespa sports spirit to an extreme. The Sprint shares the same chassis and engine as the Primavera but stands out with its trapezoidal headlamp, Black 12″ multi spoke rims and distinctive red graphics and finishes. In keeping with digital evolution, Vespa Sprint S offers a futuristic riding experience thanks to a full colour TFT multi-function display that provides vehicle status information.

-

Save over £700. Offer ends 30/04/24*

Fitted with Malossi exhaust, tinted Power 1 indicators and SIP levers.

The gutsiest small body in the range pushes that Vespa sports spirit to an extreme. The Sprint shares the same chassis and engine as the Primavera but stands out with its trapezoidal headlamp, Black 12″ multi spoke rims and distinctive red graphics and finishes. In keeping with digital evolution, Vespa Sprint S offers a futuristic riding experience thanks to a full colour TFT multi-function display that provides vehicle status information.

Sale! -

SAVE £300. Offer ends 30/04/2024*

Fifty years and counting: since its debut, Vespa Primavera has been giving voice to the youngest. The new 12-inch wheel rims with five-spoke design, the largest in Vespa history, provide stability and total safety on all road surfaces.

Sale! -

Now in full electric guise, meet the Vespa Primavera Elettrica.

-

Save £100. Offer ends 30/04/24*

Start your two-wheel experience in style and make Primavera your first Vespa. The air-cooled four-stroke 50cc engine, equipped with electronic injection, is designed to maximize quality and reliability. It allows for an extraordinary reduction in fuel consumption and emissions. The perfect engine for your first vehicle.

Sale! -

Low Rate 5.9% APR Finance*

Vespa and Disney, what more could you want than this special collaboration between two of the world most iconic brands.

-

SAVE £300 & get 5.9% APR finance, OFFER ENDS 29/02/24*

Fifty years and counting: since its debut, Vespa Primavera has been giving voice to the youngest. The new 12-inch wheel rims with five-spoke design, the largest in Vespa history, provide stability and total safety on all road surfaces.

Sale! -

SAVE £300. Offer ends 30/04/24*

Fifty years and counting: since its debut, Vespa Primavera has been giving voice to the youngest. The new 12-inch wheel rims with five-spoke design, the largest in Vespa history, provide stability and total safety on all road surfaces.

Sale! -

Save £300. Offer Ends 30/04/24*

Celebrate colour with the New Vespa Primavera 125 Colour Vibe.

-

Available Now – The biggest update since the GTV was introduced in 2006. The new GTV has a host of aesthetic, mechanical and electronic updates worthy of the range topping model.

-

The Vespa GTS SuperSport epitomises the sportiness of the Vespa marque, finished with black trim, an alcantara style seat and 5 stunning colours you are sure to stand out from the crowd.

-

The Vespa GTS SuperSport epitomises the sportiness of the vespa marque, finished with black trim, an alcantara style seat and 5 stunning colours you are sure to stand out from the crowd.

-

Vespas best selling model the GTS Super features black wheels with a diamond finish and a double upholstered seat with white edging, LED front and rear lighting creates a high-impact look and increases safety.

-

Vespas best selling model the GTS Super features black wheels with a diamond finish and a double upholstered seat with white edging, LED front and rear lighting creates a high-impact look and increases safety.

-

The top-of-the-range Vespa GTS 125 SuperTech combines Vespas timeless design and class leading performance with a 4.3″ Colour TFT screen with navigation and phone connectivity.

-

The Vespa GTS 125 SuperSport has been given a big update, fully restyled with new lights, rims and seat as well as better brakes, keyless ignition and an updated dashboard all while retaining everything you love from this best selling model.

-

The Vespa GTS 125 Super has been given a big update, fully restyled with new lights, rims and seat as well as better brakes, keyless ignition and an updated dashboard all while retaining everything you love from this best selling model.

-

The Vespa GTS 125 has been given a big update, fully restyled with new lights, rims and seat as well as better brakes, keyless ignition and an updated dashboard all while retaining everything you love from this best selling model.

-

Huge Saving – Black Trim Only.

Silent, ecological, innovative and today more powerful. A development of Piaggio Group’s experience with electrical power units and lithium ion battery, this new Vespa now has a top speed of 70km/h (45mph) and a range of 50 miles in power mode.

OTR Price includes £500 OZEV grant.

Sale! -

Huge Saving – One Black bike only.

It is not a new electric scooter, it is Vespa Elettrica, it is a work of art with a technological heart that is born as the symbol of our modern times and the years to come.

OTR Price includes the OLEV grant.

Sale! -

Celebrate the Chinese year of the Dragon with this exclusive bike. Limited to 1888 units worldwide.

-

Justin Bieber x Vespa: Italian style meets California Cool.

Vespa have teamed up with pop sensation Justin Bieber to create a truly distinctive limited edition Sprint that will be available in showroom from May 2022.

“The first time I rode a Vespa was somewhere in Europe, probably either London or Paris. I just remember seeing a Vespa and being like ‘I want to ride one of those’. And I had such a great time, just the wind flying through my hair, the freedom. It was fun.” Justin Bieber

-

5.9% APR Finance. Offer ends 29/02/2024

The Piaggio Zip 50 4T Euro 5 retains the same characteristics as its two-stroke twin when it comes to aesthetics and functionality but also boasts a further advantage: the advanced ecological single cylinder four-stroke engine with three-valve distribution, making it a responsible choice when it comes to exhaust emissions.

-

Save £750, (price before discount £11500). Offer ends 30/04/2024*

For 2022 the MP3 have been given the biggest make over since its launch, updated sporty bodywork compliment a new 530cc engine providing more power, lights are now fully LED, there is a new colour TFT dash and the bike has been adorned with all the rider aids you could need.

Sale! -

Save £600, (price before discount £9800). Offer ends 30/04/24*

With its modern, efficient engine, advanced instrumentation, perfect ergonomics, outstanding safety features and elegant, dynamic design, the Piaggio MP3 400 Sport has everything you could want in a bike. You can stop searching – you’ve found your ideal companion for your future trips, and with all the comforts of its three wheels, you are in for a truly revolutionary riding experience.

Sale! -

Save £500 (price before discount £7250). Offer ends 30/04/24*

MP3 300 HPE Sport is an evolution born from the original concept of MP3 fully evolved as a new version. It is more dynamic and more easy in terms of drivability and dimensions, giving a new and unique experience in riding, safety and comfort. Characterised by a modern design, with improved functionality and enhanced performance, the MP3 300 HPE incorporates contents and values required of a touring scooter.

Sale! -

£250 registration bonus (off RRP £3600), offer ends 30/04/2024.*

The Medley S emphasises the sporty nature of Piaggios range topping 125 scooter. The new Piaggio Medley creates a new class of Piaggio high-wheel scooters that combines the advantages of an agile and lightweight scooter with those of a larger and more powerful high-wheel bike.

Featuring the latest version of Piaggios liquid cooled i-Get engine boasting 15hp this 125 is one step ahead of the rest.

-

£250 Registration offer ends 30/04/2024 (price before discount £3500)*

The new Piaggio Medley creates a new class of Piaggio high-wheel scooters that combines the advantages of an agile and lightweight scooter with those of a larger and more powerful high-wheel bike.

Inspired by the large, modern and elegant lines of its bigger sibling Beverly, the new Piaggio Medley’s light weight and dynamism make it ideal for city use.

-

Save £250 or 5.9% APR Finance. Offer Ends 30/04/24, price quoted after discount applied*

Featuring a number of cosmetic changes to enhance the sportiness of the bike. The Piaggio Liberty S 125 is the perfect solution for those seeking that elusive combination of style, lightness, easy driving and safety. What sets it apart is its superior standards of maneuverability, agility and reliability together with its sound technological base, for example ABS braking and the three-valve, air cooled i-get (Intelligent green engine technology) engine.

Sale! -

9.9% PR Finance. Offer ends 30/04/2024

Powered by a single cylinder 50 cc engine which uses i-get (Italian Green Experience Technology) with a three-valve timing system it offers impeccable performance and reliability as well as reduced fuel consumption. Scrupulous attention has also been afforded to the construction of the body and finishes to ensure maximum safety and the best possible driving experience, with the wide wheels (14 at the rear and 16 up front) delivering greater precision and maneuvering.

-

SAVE £250 or 5.9% APR Finance. Offer ends 30/04/2024, price quoted after discount has been applied*

The Piaggio Liberty 125 ABS is the perfect solution for those seeking that elusive combination of style, lightness, easy driving and safety. What sets it apart is its superior standards of maneuverability, agility and reliability together with its sound technological base, for example ABS braking and the three-valve, air cooled i-get (Italian Green Experience Technology) engine.

Sale! -

The New Piaggio Beverly 400S sets a new benchmark in performance for the class and had been enhanced with a range of upgrades including, LED lights, keyless ignition and a LCD dash.

-

The Piaggio Beverly 300 HPE improves upon the already excellent bike with a host of updates including fully revised styling, LED lights, keyless ignition and a LCD dash.

-

Save £300. Offer ends 30/04/2024

The all new Piaggio 1 is the bike the electric moped market has been waiting for, fantastic looks, plenty of tech, removable batteries and a price making it the cheapest 50cc (equivalent) in Piaggios line up. What are you waiting for?

Price includes £150 OZEV grant & discount.

-

Save £300. Offer ends 30/04/2024

The all new Piaggio 1 is the bike the electric moped market has been waiting for, fantastic looks, plenty of tech, removeable batteries and a price making it the cheapest 50cc (equivalent) in Piaggios line up. What are you waiting for?

Price includes £150 OZEV grant & discount.

-

Save £300. Offer ends 30/04/2024*

The all new Piaggio 1 Feng Chang Wang combines start of the art Motorcycle engineering with cutting edge fashion to deliver this years hottest electric scooter. This Active version provides ideal city performance with a top speed of 37mph and upto 41 battery range in spot mode.

Price includes £500 OZEV grant & discount.

-

Save £300. Offer ends 30/04/24*

The all new Piaggio 1 is the bike the electric moped market has been waiting for, fantastic looks, plenty of tech, removable batteries this Active version provides improved performance and battery range over the standard version.

Price includes £500 OZEV grant

-

Save £1400 or 5.9% APR. Offer ends 30/04/2024

New for 2023 this Limited run Speed White colourway is available to order now.

Sale! -

Over £3000 of extras fitted. 5.9% APR, Offer ends 30/04/2024

The best selling Aprilia Tuono V4 1100 Factory comes in a stunning new “time attack” colour for 2023.

Now fully loaded with accessories.

Sale! -

Save £1400 or 5.9% APR. Offer ends 30/04/2024

The best selling Aprilia Tuono V4 1100 Factory comes in a stunning new “time attack” colour for 2023.

Sale! -

Save £1100 or 5.9% APR. Offer ends 30/04/2024

New Red colour option for 2023.

Sale! -

Save £750, 5.9% APR, Offer ends 29/02/2024

-

Save £750 or 5.9% APR. Offer ends 30/04/2024

More spec, more power and less weight. Whats not to love? The new 2023 Toofast livery looks the part too!

Sale! -

Save £750 or 5.9% APR, Offer ends 30/04/2024

The highly anticipated Tuono 660 – takes the legendary Aprilia Tuono V4 into the medium engine capacity segment.

Worthy child of the unbeatable Tuono V4 1100, the new Tuono 660 combines manageable power and light weight, for great performance available to all, refined chassis architect and an electronic controls package derived directly from the Tuono V4.

Aprilia Tuono 660 embraces the concepts of sporty versatility, ease and fun that Aprilia is introducing for a new generation of riding enthusiasts.Sale! -

Save £250 or 5.9% APR, Offer ends 29/02/2024

Aprilia’s Legendary RS125 lives on with this fully updated 2021 model. Featuring bold new design language inherited from its big brother the RS660, improved engine, LED headlights, new ECU and improved ABS this bike should comfortably retain its title as of king of the 125’s

Sale! -

Save £750 or 5.9% APR, Offer ends 30/04/2024

Finally unveiled the Tuareg looks set be live up to the hype. With a reworked 660 engine producing 80Hp and 70.5Nm of torque, off road KYB suspension, Brembo brakes and a dry weight of only 187kg. 2022 looks like its going to be a lot of fun!

Sale! -

Save £750 or 5.9% APR. Offer Ends 30/04/24*

The Tuareg 660 lives up to the hype. With a reworked 660 engine producing 80Hp and 70.5Nm of torque, off road KYB suspension, Brembo brakes and a dry weight of only 187kg this is the middleweight dual sport to beat.

Sale! -

5.9% APR, Offer ends 29/02/2024

All new for 2021 the SXR 50 is the latest in line of sports scooters from the Italian marque. Featuring the latest 4 stroke fuel injection technology and LED lighting enhanced by distinct Aprilia styling this bike it due to set a new benchmark for the segment.

-

MSC Special. Save £400, 5.9% APR. All colours available

Heir of Aprilia’s history of success in off-road competitions, the updated SX 125 boasts a sophisticated design, powerful performance and advanced technology that makes this bike for people who want to stand out from the crowd right from the start of their two-wheel career. The SX offers great riding satisfaction to anyone climbing on-board.

Sale! -

5.9% APR, Offer ends 29/02/2024

Aprilia SR GT, the “urban adventure” scooter from Aprilia designed to rediscover the fun in daily riding, makes its début in the special and super-sporty Replica version with aesthetics taken directly from the Aprilia RS-GP, the bike ridden by Aleix Espargaró and Maverick Viñales, protagonists in the 2023 MotoGP World Championship.

-

5.9% APR. Offer ends 29/04/2024

All new for 2022 the SR GT 125 is Aprilias first Urban-Adventure scooter, boasting a host of class leading features and stunning styling this bike raises the bar for sports 125’s

-

5.9% apr finance. Offer ends 30/04/24

All new for 2022 the SR GT 125 is Aprilias first Urban-Adventure scooter, boasting a host of class leading features and stunning styling this bike raises the bar for sports 125’s

-

MSC Special. Save £400, 5.9% APR. ONLY TWO LEFT!!

Heir of Aprilia’s history of success in off-road competitions, the updated RX 125 boasts a sophisticated design, powerful performancae and advanced technology that makes this bike for people who want to stand out from the crowd right from the start of their two-wheel career. The RX offers great riding satisfaction to anyone climbing on-board.

Sale! -

Save £1700 or 5.9% APR. Offer ends 30/04/2024

Limited run Speed white colorway now available to order.

Sale! -

-

SAVE £1700 or 5.9% ARP. Offer ends 29/02/24*

*or 5.9% APR HP/PCP 36 month finance plan – 10% minimum deposit – bike at full RRP.

*Offers may change or be withdrawn at any time and without notice. Finance subject to status, Minimum Deposit, Maximum term. No cash alternative.

Stunning new Time Attack Livery for 2023.

Sale! -

Save £1300 or 5.9% APR. Offer Ends 30/04/24*

*or 5.9% APR finance 36 month finance plan – 10% minimum deposit – bike at full RRP.

The Aprilia RSV4 comes in two new colours for 2023, Silverstone Grey and Sachsenring Black

Sale! -

Save £750 or 5.9% APR. Offer ends 30/04/2024

Extreme in every sense – the Aprilia RS660 Extrema comes with some tasty extras, stunning livery and weighs 3kg less than the standard model.

Sale! -

Save £750 or 5.9% APR. Offer ends 30/04/2024

The Aprilia RS660 has redefined the middleweight supersport market. Featuring Aprilias full compliment of electronic goodies, a modern look and a chassis fine tuned by the best in the business. all without a wallet busting price tag.

Sale! -

This one-off RS660 “X” Replica has been fitted with a host of Evotech goodies and is a bargain price!

-

£99 refundable deposit – Pre-Order now and get a free Quickshifter.

Weight and power have never had a better ratio.

The Aprilia RS 457 speaks the language of those who are not satisfied and want to approach the fairing motorbike using all the historical knowledge of a true sports bike. In simple words: the best power-to-weight ratio for the A2 licence.

-

£99 refundable deposit – Pre-Order now and get a free Quickshifter

Weight and power have never had a better ratio.

The Aprilia RS 457 speaks the language of those who are not satisfied and want to approach the fairing motorbike using all the historical knowledge of a true sports bike. In simple words: the best power-to-weight ratio for the A2 licence.

-

Save £250 or 5.9% APR. Offer ends 30/04/24

Aprilias Legendary RS125 lives on with this fully updated model. Featuring bold design language inherited from its big brother the RS660, improved engine, LED headlights, new ECU and improved ABS this bike should comfortably retain its title as of king of the 125’s this GP Replica version also comes with a quickshifter and single seat conversion.

Sale! -

Save £250 or 5.9% APR. Offer ends 30/04/2024

Aprilias Legendary RS125 lives on with this fully updated 2021 model. Featuring bold new design language inherited from its big brother the RS660, improved engine, LED headlights, new ECU and improved ABS this bike should comfortably retain its title as of king of the 125’s

Sale!

-

The new Special Version of the distinctive Bobber enhances the bikes dual spirit of boldness and elegance with truly unique details.

-

Moto Guzzi reinterprets the straightforward and aggressive style of the legendary Bobber. Chrome elements make way for matt colours and a chessboard tank graphic while the first-class metal mudguards and imposing tyres emphasise the bike’s true grit. Shaft drive and an 853cc transverse V-twin engine housed in a steel frame epitomise the essence of Moto Guzzi conveyed in true Bobber style.

-

5.9% APR Finance or Save £1000 offer ends 30/04/24

The Moto Guzzi V85 TT Travel now features more torque, lightweight tubeless rims and additional riding modes making your perfect travel companion even more perfect. The V85 TT Travel comes fitted with the following.

- Urban Panniers

- Touring Windscreen

- Heated Grips

- Moto Guzzi MIA Miltimedia System

- Centre Stand

*Offer may change or be withdrawn at any time and without notice. Finance subject to status, Minimum Deposit, Maximum term. No cash alternative.

Sale! -

5.9% APR Finance or Save £1000 offer ends 30/04/24

The Moto Guzzi V85 TT Guardia D’Onore is special edition to commemorate 75 years continued service to the Italian Presedential Honour Guard, limited to only 1946 units worldwide and includes the following

- Unique black and white livery

- Touring Windscreen with Italian flag

- LED Auxiliary Fog Lights

- Centre Stand

- Engine Protection bars.

*Offer may change or be withdrawn at any time and without notice. Finance subject to status, Minimum Deposit, Maximum term. No cash alternative.

Sale! -

5.9% APR Finance or Save £1000 offer ends 30/04/2024

The Moto Guzzi V85 TT Evocative now has improved performance, tubeless rims, updated graphics and additional riding modes. The V85 TT beautifully blends the allure of the famous Mandello Eagle with the lines of modern classics to create the perfect bike for any type of journey on any terrain. The new for 2023 – Blu Uyuni colourway

*Offer may change or be withdrawn at any time and without notice. Finance subject to status, Minimum Deposit, Maximum term. No cash alternative.

Sale! -

5.9% APR Finance or Save £1000 offer ends 30/04/24

Offering improved performance, better fuel economy and the distinctive styling uniquely “Moto Guzzi” the V85 TT is your ideal middleweight touring companion.

*Offer may change or be withdrawn at any time and without notice. Finance subject to status, Minimum Deposit, Maximum term. No cash alternative.

Sale! -

5.9% APR Finance. Offer ends 29/02/2024

The V7 generation takes boldness up another notch with a brand-new model inspired by Moto Guzzi’s legendary racing history. The special edition V7 Stone Corsa is designed as an expression of the sportiest side of the Mandello icon that has long been a symbol of style and dynamic spirit.

-

Pre Order Now!

More of what you love – the V7 Stone Ten honours 10 years of the “The Clan”

Reserve yours now with £99 Deposit.

-

5.9% APR Finance. Offer ends 29/02/2024

More of what you love – the V7 Stone Special Edition offers more performance and sportier styling than the standard version.

Reserve yours now with £99 Deposit.

-

5.9% APR Finance, Offer ends 29/02/24

After many years of success a new V7 is born; Featuring a new high performance 850cc engine producing 65hp the V7 850 is faster, more comfortable and better equipped while maintaining all the character and authenticity that is at the heart of any Moto Guzzi,

-

5.9% APR Finance. Offer ends 29/02/2024

After many years of success a new V7 is born; Featuring a new high performance 850cc engine producing 65hp the V7 IV is faster, more comfortable and better equipped while maintaining all the character and authenticity that is at the heart of any Moto Guzzi,

-

Save £1000 and 5.9% APR, Offer ends 30/04/2024

Unveiled on 11/9/21 the all new Moto Guzzi V100 Mandello opens a new chapter in the line up of Moto Guzzi Motorcycles. This top spec “S” version enhances the bike with extra tech for increased performance and comfort.

Sale! -

Save £1700 over new.

Sale! -

Limited Edition – 1913 Worldwide

The Mandello Eagle spreads its wings on the spectacular aircraft carrier Cavour with a new limited edition model: Moto Guzzi V100 Mandello Aviazione Navale.

Sale! -

Save £1000 or 5.9% Apr Offer ends 30/04/2024

Unveiled on 11/9/21 the all new Moto Guzzi V100 Mandello opens a new chapter in the line up of Moto Guzzi Motorcycles. V100 signifies both the Anniversary of the historic brand but also gives a hint tothe engine capacity in typical Moto Guzzi Style.

Sale! -

Pre-Order now – Due April

-

-

Looking for a run-around motorcycle with the enjoying racy look of a larger machine? Look no further than the all-new Tornado Naked T, available in 125cc versions. The new Tornado Naked T has been created to win the hearts of a user that demands the utmost from their equipment, while still providing an unparalleled, enjoyable experience.

Sale! -

The Top-of-the-range Benelli Leoncino 125 gives you more of what you love with a more powerful liquid cooled engine, better suspension and improved technology while maintaining a style unmistakably Benelli.

Sale! -

Benelli BN 125 is the new compact naked motorcycle from Benelli that is designed to capture the hearts of the newest generation of motorcycle riders.

Sale!

-

The TG is based upon the styling of the original TV175 series 2 model, in particular the ‘curvy horn cast and scalloped side panels, the large front fender & the unique ‘Gem Eye’ built into the headset.

Sale! -

The TG range caused a stir in 2020, fully embracing the mix of authentic retro style with modern technology, an echo of the past made real and practical for the 21st century

Sale! -

The TG is based upon the styling of the original TV175 series 2 model, in particular the ‘curvy horn cast and scalloped side panels, the large front fender & the unique ‘Gem Eye’ built into the headset.

Sale! -

Stunning retro styled scooter at a great price.

Sale! -

CLASSIC, RETRO-STYLE SCOOTER GP 300 SE FOR THE ULTIMATE RIDE

-

The GP series really was a breakthrough for Royal Alloy – and for the real retro scootering fraternity! The Royal Alloy GP300 features a reliable and proven engine, advanced anti-dive front suspension, Bosch ABS system, digital clocks and LED lighting.

Sale! -

Performance and specification fused into a perfect package of usability, jaw dropping looks and attention to detail elevates this attention grabbing machine into something impossible to ignore.

Sale! -

Royal Alloy GP 125 – where the technology of today meets the strengths of the past. Metal bodied, clean precise lines encases a smooth, versatile fuel injected heart, pushing you past a mere trip into the journey your soul desires.

Sale!